child tax credit for december 2021 amount

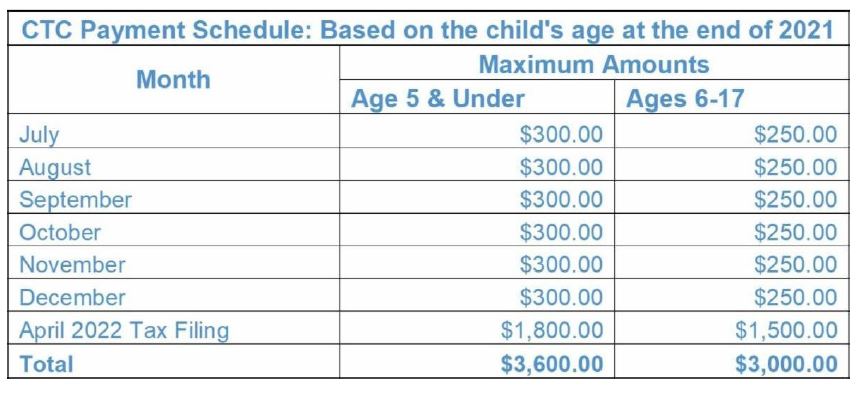

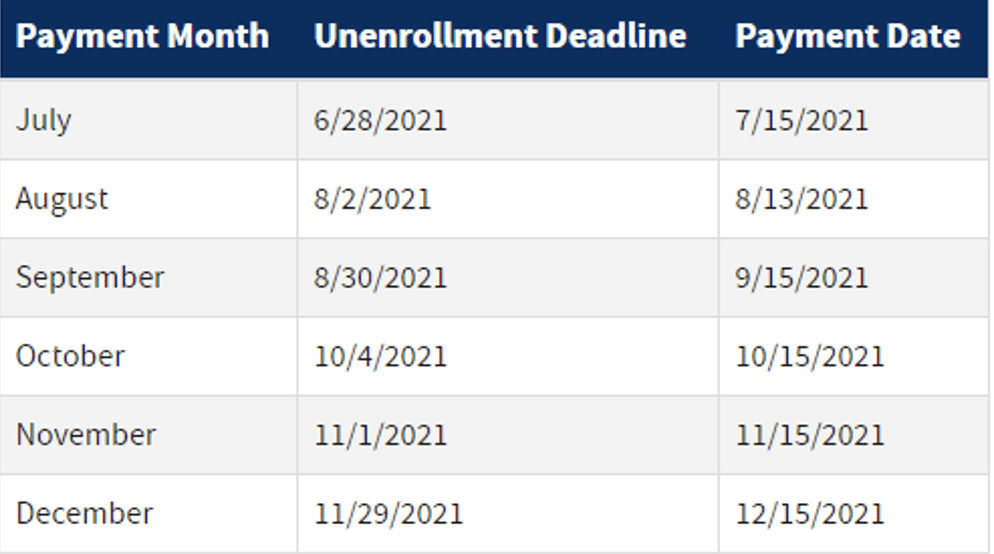

The tax credits maximum amount is 3000 per child and 3600 for children under 6. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families.

. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The two most significant changes.

That comes out to 300 per month through the. Heres an overview of what to know. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

Have been a US. The enhanced child tax credit expired at the end of December. Your newborn should be eligible for the Child Tax credit of 3600.

Last updated April 05 2022. A childs age determines the amount. For 2021 eligible parents or guardians.

Unless Congress takes action the 2020 tax credit rules apply in 2022. The credit amount was increased for 2021. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children.

Half the amount 1800 was available in six monthly installments during the year. If you did not receive the stimulus for a. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

Increases the tax credit amount. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. The 2021 CTC is different than before in 6 key ways.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. These people are eligible for the. It helped roughly 60 million children and helped cut child.

The credit amounts will increase for many. Your newborn child is eligible for the the third stimulus of 1400. The child tax credit for 2021 pays out 3600 for each eligible child under the age of six.

By The Kiplinger Washington Editors. Big changes were made to the child tax credit for the 2021 tax year.

Child Tax Credit Monthly Advance Payments To Start Arriving July 15

The December Child Tax Credit Payment May Be The Last

The 2021 Child Tax Credit John Hancock Investment Mgmt

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit December 2021 How To Track Your Payment Marca

Will You Have To Repay The Advanced Child Tax Credit Payments

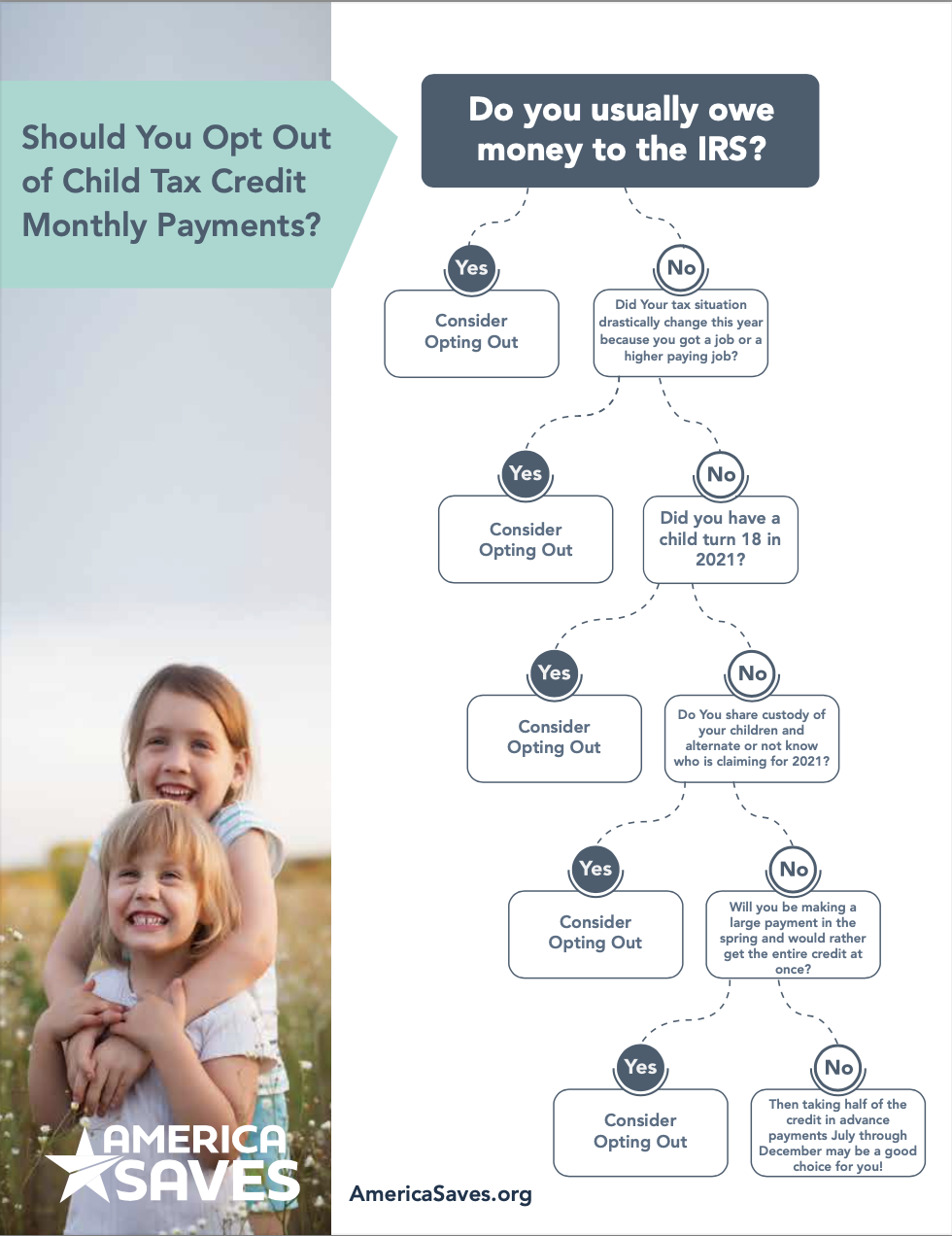

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

What Families Need To Know About The Ctc In 2022 Clasp

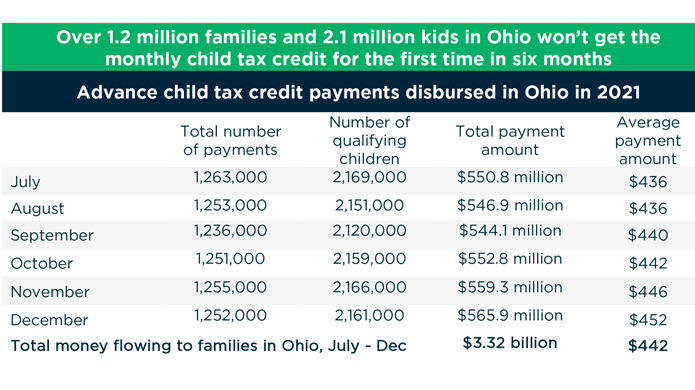

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

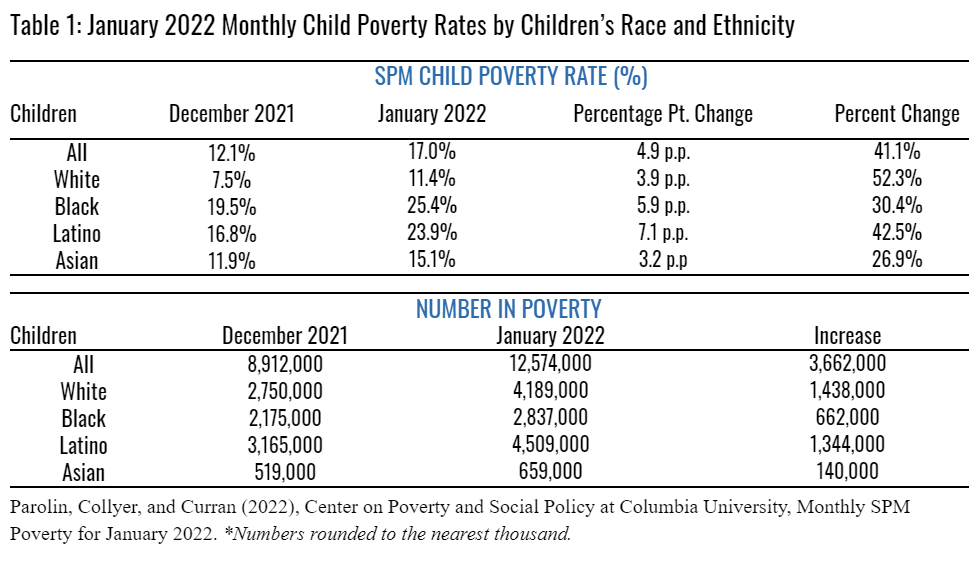

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Irs Will Send Out The Last Advance Child Tax Credit Payment By December 15 2022 Where S My Refund Tax News Information

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Newsletter Monthly Payments Are On The Way To Hardworking Maryland Families Congressman Steny Hoyer